When tax season comes around, most individuals are familiar with the W2 form, which summarizes their annual income and taxes withheld by their employer. However, the world of taxes extends beyond the W2 form, with various other crucial tax forms that taxpayers should be aware of. These forms play essential roles in reporting different types of income, deductions, and credits. In this article, we will explore three important tax forms beyond the W2 that you should know about.

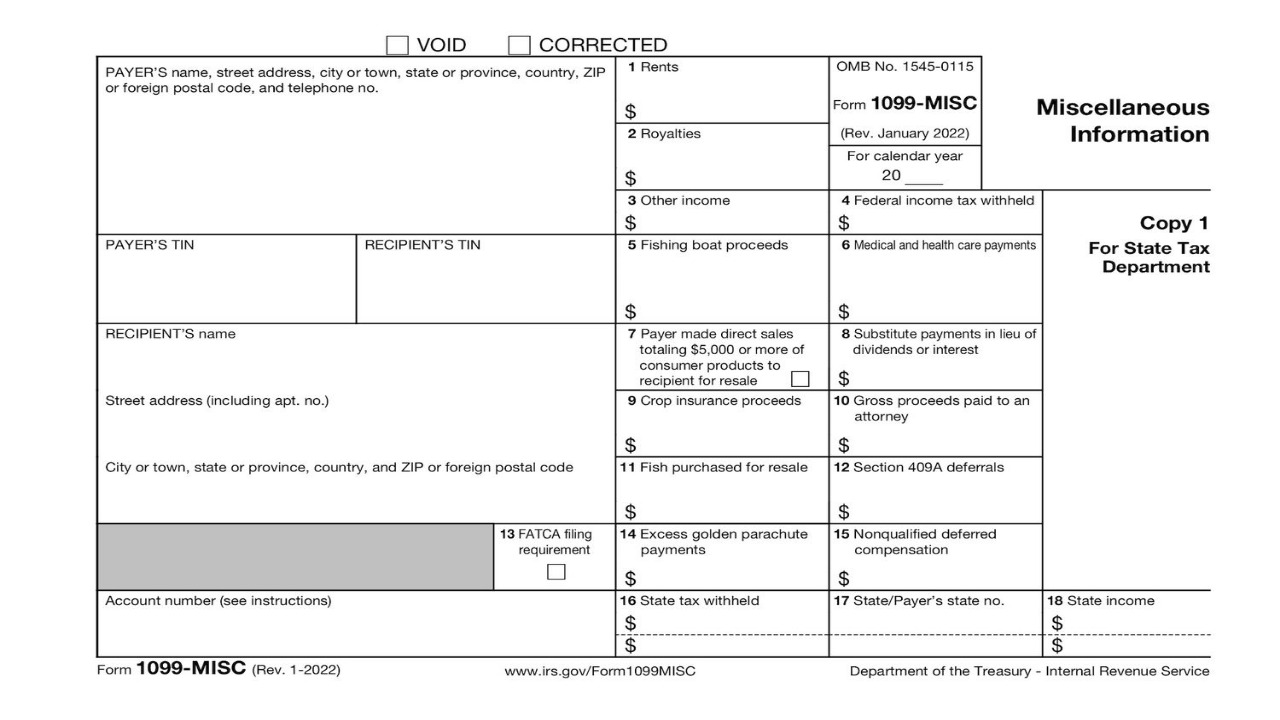

Form 1099-MISC: Reporting Miscellaneous Income

Form 1099-MISC, also known as the Miscellaneous Income form, is issued to taxpayers who receive non-employee compensation during the tax year. This form is commonly used by freelancers, independent contractors, and self-employed individuals who have earned income from various sources outside of traditional employment. Additionally, businesses that make payments of at least $600 to individuals, partnerships, or corporations for rent, royalties, prizes, awards, or other types of income must also issue Form 1099-MISC. However, if you need a W-2 form, you can use a W-2 form generator.

When you receive a Form 1099-MISC, it is crucial to report the income accurately on your tax return. Failure to do so can result in underreporting of income and may trigger an audit from the IRS. Keep track of all your 1099-MISC forms, and be sure to include them when filing your taxes to ensure compliance and avoid potential penalties.

Form 1040 Schedule C: Reporting Business Income and Expenses

For those engaged in a sole proprietorship or operating a small business, Form 1040 Schedule C is an essential tax form used to report business income and expenses. This form accompanies the standard Form 1040 and allows entrepreneurs to calculate their net profit or loss from their business activities.

When completing Schedule C, it is vital to be meticulous in detailing your business income and deductible expenses. Keeping accurate records of all business-related transactions throughout the year can significantly simplify the process. Deductible expenses may include office supplies, travel expenses, advertising costs, and other business-related expenditures. Reporting these expenses appropriately can help reduce your taxable income, leading to potential tax savings.

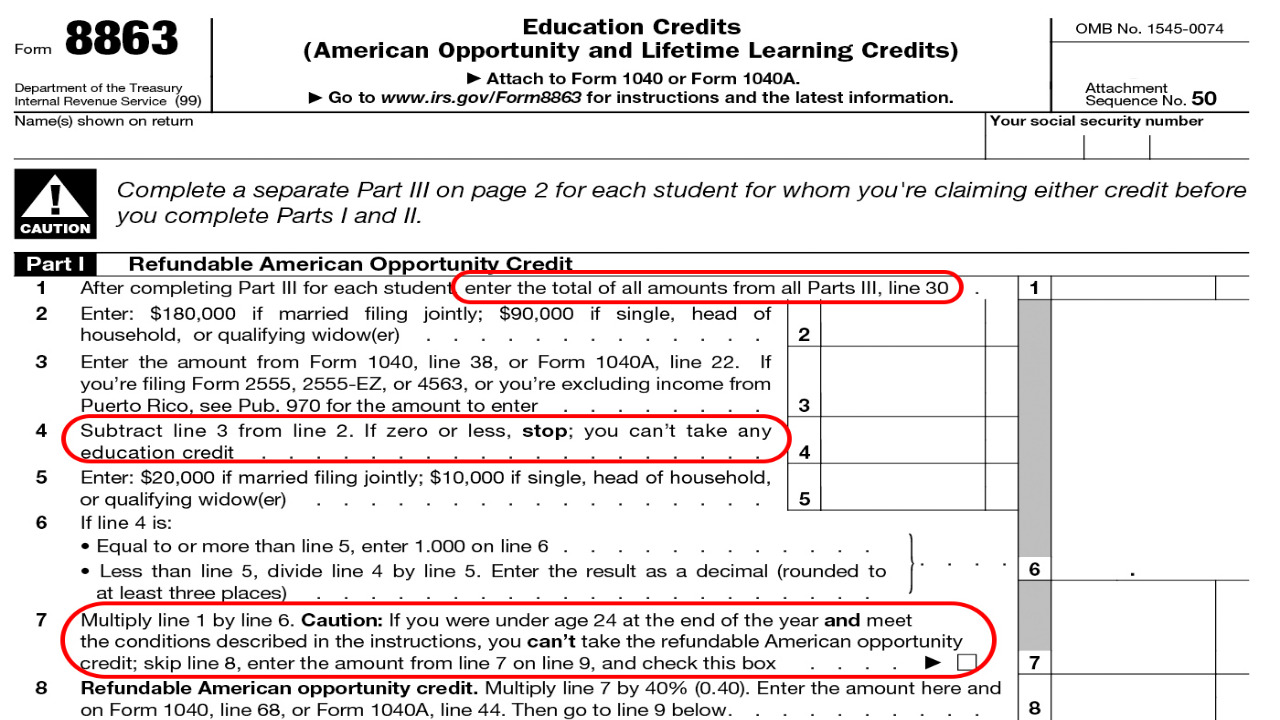

Form 8863: Claiming Education Credits

Education can be a significant financial investment, and fortunately, the IRS offers tax credits to help ease the burden. Form 8863, also known as the Education Credits form, allows eligible taxpayers to claim the American Opportunity Credit or the Lifetime Learning Credit. These credits can directly reduce the amount of tax you owe, providing valuable financial assistance for qualified education expenses.

The American Opportunity Credit is geared towards undergraduate students, offering a credit of up to $2,500 per student for qualified expenses like tuition, fees, and course materials. On the other hand, the Lifetime Learning Credit provides up to $2,000 per tax return for both undergraduate and graduate courses and can be claimed for an unlimited number of years.

https:/

To claim these credits, you must meet certain eligibility requirements and have the necessary documentation, such as Form 1098-T, which reports your educational expenses from an eligible educational institution. Make sure to review the IRS guidelines and consult with a tax professional to determine your eligibility and ensure you claim the appropriate credit.

In conclusion, tax season involves more than just the W2 form. Understanding and familiarizing yourself with other important tax forms such as Form 1099-MISC, Form 1040 Schedule C, and Form 8863 can lead to a smoother and more accurate filing process. It’s crucial to be diligent in gathering the necessary information and seeking professional advice if needed to maximize deductions, credits, and overall tax efficiency. Taking the time to grasp these forms will empower you to navigate the complex world of taxes with confidence.